ConvaTec Announces Certain Preliminary Unaudited Financial Results for Fourth Quarter and Full Year 2011

Media

SKILLMAN, NJ, (February 21, 2012) - ConvaTec Healthcare B, S.a.r.l. (the "Company"), today released certain preliminary unaudited financial information for its fiscal fourth quarter and full year ended December 31, 2011. Such information remains preliminary and subject to audit.

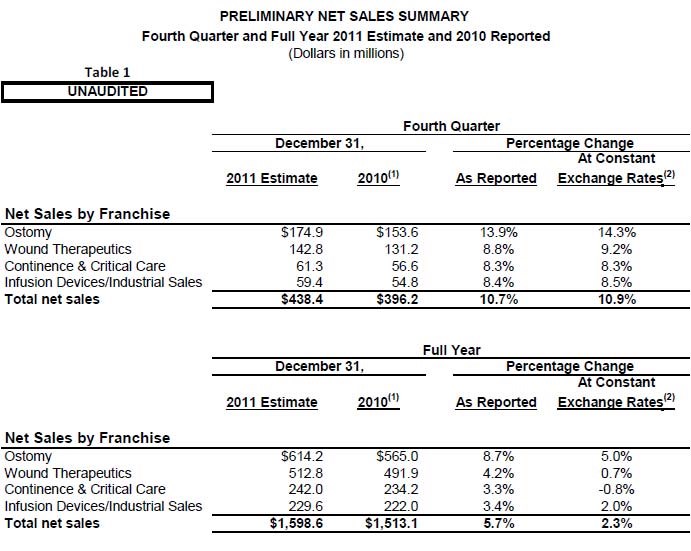

The Company expects net sales for the fiscal fourth quarter in 2011 to total approximately $438.4 million as compared to net sales of $396.2 million for the fiscal fourth quarter 2010, an increase of 10.7% on an as reported basis and 10.9% at constant exchange rates. For the year ended December 31, 2011 the Company expects net sales to total approximately $1.6 billion as compared to net sales of $1.5 billion for the year ended December 31, 2010, an increase of 5.7% on an as reported basis or 2.3% at constant exchange rates. Net sales amounts as presented for 2011 are preliminary and unaudited. See Table 1 (below) for the Company's estimated net sales for 2011 by franchise as compared to 2010.

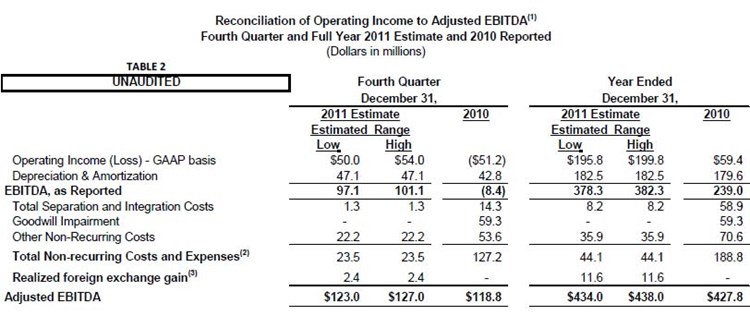

The Company expects its Adjusted EBITDA for the fiscal fourth quarter in 2011 to total between $123.0 million and $127.0 million as compared to Adjusted EBITDA of $118.8 million for the fiscal fourth quarter of 2010. For the year ended December 31, 2011, the Company expects its Adjusted EBITDA to total between $434.0 million and $438.0 million as compared to Adjusted EBITDA of $427.8 million for the year ended December 31, 2010.

Adjusted EBITDA is a non-GAAP financial measure which is defined as net earnings before interest expense, income taxes, depreciation and amortization, and further adjusted to exclude goodwill and asset impairment charges, loss on debt extinguishment, separation and integration costs incurred in connection with acquisitions of ConvaTec and Unomedical and other non-recurring items. See Table 2 (below) for a reconciliation of the Company's estimated operating income to estimated Adjusted EBITDA, for the fiscal fourth quarter and full year ended December 31, 2011 compared to the same periods in 2010.

The Company was in compliance with all financial covenants under its secured and senior notes and its bank credit facilities as of December 31, 2011.

The Company expects to issue its annual report, including complete 2011 financial results in April 2012 upon completion of its annual audit. All 2011 amounts included herein are unaudited and are therefore subject to change.

About ConvaTec

ConvaTec is a leading developer and marketer of innovative medical technologies that have helped improve the lives of millions of people worldwide. With four key focus areas - Ostomy Care, Wound Therapeutics, Continence and Critical Care, and Infusion Devices - ConvaTec products support healthcare professionals from the hospital to the community health setting.

Forward Looking Statement

This press release includes "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934, as amended. All statements included herein, other than statements of historical fact, may constitute forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Important factors that could cause actual results to differ materially from the Company's expectations are disclosed in the risk factors contained in the Company's annual report for the year ended December 31, 2010 which is available on the Company's website under the Investor Community tab. All forward-looking statements are expressly qualified in their entirety by such risk factors.

# # #

(1)As reported in prior quarterly reports, during the second quarter of 2011 the Company altered its management and reporting of the CCC franchise. As a result of this change, and to better align the disclosures with current franchise management, certain sales that were previously part of the CCC franchise are now included in our Ostomy Care franchise and our ID/IS franchise. For comparability purposes, we have reclassified similar amounts for the 2010 periods presented. For the fourth quarter of 2010, $2.3 million has been reclassified from CCC to Ostomy Care and $8.8 million has been reclassified from CCC to ID/IS. For the year ended December 31, 2010, $8.2 million has been reclassified from CCC to Ostomy Care and $20.8 million has been reclassified from CCC to ID/IS.

(2)Represents supplemental net sales fluctuations between preliminary and unaudited 2011 net sales and 2010 net sales, excluding the impact of foreign currency fluctuations. The net sales fluctuations excluding foreign currency impacts is a non-GAAP measure and does not replace the presentation of our GAAP net sales fluctuations, included herein. We have provided this supplemental information because it may provide meaningful information regarding our results on a basis that facilitates an understanding of our net sales which may not be otherwise apparent under GAAP. Management evaluates net sales comparisons, excluding currency impacts, along with the GAAP comparisons in analyzing sales trends in the business. In addition, we believe some investors may use this information in a similar fashion.

(1) The Company's definition of Adjusted EBITDA may not be comparable to similar measures disclosed by other companies. The Company believes that Adjusted EBITDA as a supplementary non-GAAP financial measure may be used by Investors to meaningfully evaluate the Company's future operating performance and cash flow. Moreover, the definition of Adjusted EBITDA as presented herein is also consistent with financial measurements required to be used to determine compliance with certain financial covenants under the Company's new credit facilities and secured and senior notes. In addition to these recognized purposes, management also uses EBITDA and Adjusted EBITDA to assess and measure the Company's performance.

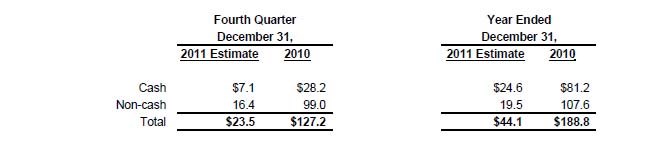

(2) For the Fourth Quarters and Years ended December 31, 2011 (estimated) and 2010, the split of non-recurring costs between cash-related and non-cash are as follows:

(3) Effective January 1, 2011 in conjunction with our December 22, 2010 refinancing, pursuant to the new credit agreement, realized foreign exchange gains and losses were included in the Adjusted EBITDA profit measure.